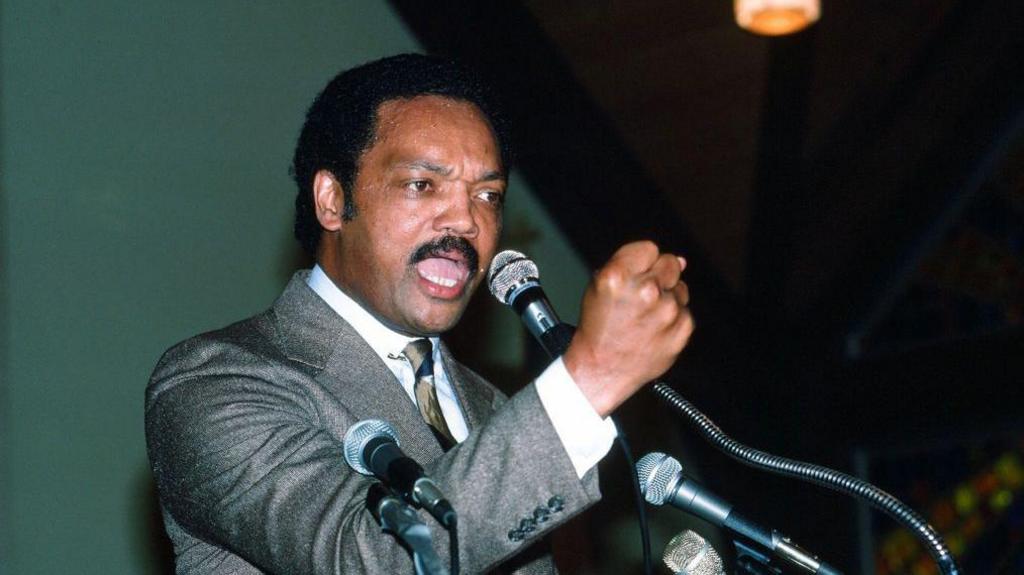

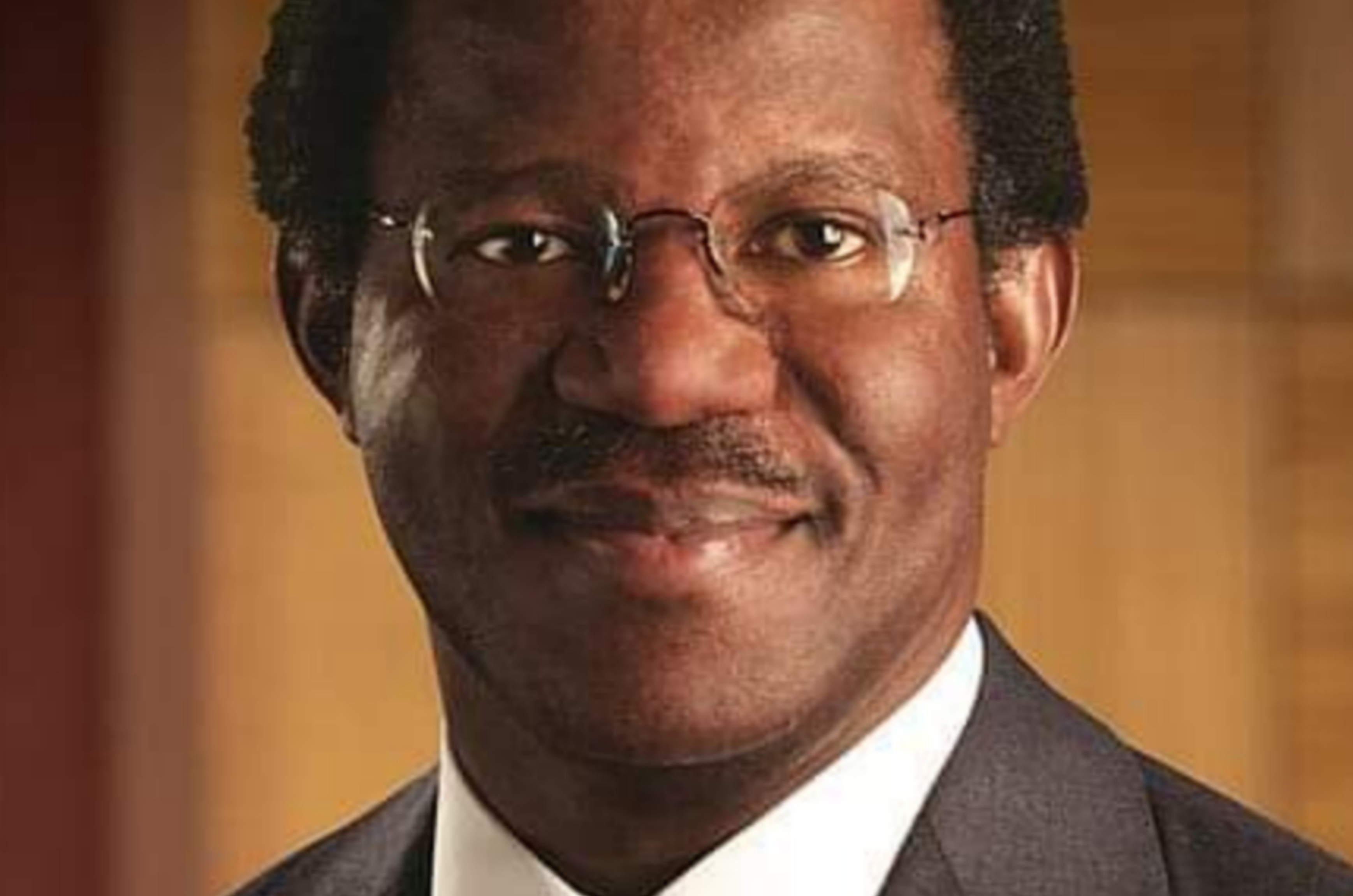

ADEBAYO OGUNLESI, The Nigerian Lawyer Turns Investment Banker

Did you know that Adebayo Ogunlesi, whose firm (Global Infrastructure Partners, GIP) is bought by American institutional investment company BlackRock Inc. for $12.5 billion, is the son of the first Nigerian professor of medicine at University of Ibadan?

Adebayo "Bayo" O. Ogunlesi CON is a Nigerian lawyer and investment banker who started the private equity firm, Global Infrastructure Partners (GIP). Formerly, he was the head of global investment banking at Credit Suisse First Boston before being promoted to chief client officer and executive vice chairman.

Ogunlesi, born 20 December 1953, hails from Makun, Sagamu in Ogun State, Nigeria. He is the son of Theophilus O. Ogunlesi, the first Nigerian professor of medicine at University of Ibadan. He attended King's College in Lagos, and received a B.A. with first class honors in philosophy, politics and economics from Oxford University in England. In 1979, he received a JD–MBA from Harvard Law School and Harvard Business School. During his time at Harvard, he was on the Harvard Law Review.

From 1980 to 1981, Ogunlesi served as a law clerk to associate justice Thurgood Marshall of the United States Supreme Court. He was an attorney in the corporate practice group of the New York City law firm of Cravath, Swaine & Moore, where he had been a summer associate while studying for his M.B.A.

In 1983, he joined the investment bank First Boston as an advisor on a Nigerian gas project. At First Boston, he worked in the Project Finance Group, advising clients on transactions and financings and has worked on transactions in North and South America, the Caribbean, Europe, the Middle East, Africa and Asia. From 1997 to 2002, he was the Head of the Global Energy Group of the by then renamed Credit Suisse First Boston (CSFB). In 2002, Ogunlesi was appointed Global Head of CSFB's Investment Banking Division. Also in 2002, he served as a member of Credit Suisse's Executive Board and Management Committee. From 2004 to 2006, Ogunlesi was Executive Vice Chairman and Chief Client Officer of CSFB.

In July 2006, Ogunlesi started the private equity firm, Global Infrastructure Partners (GIP), a joint venture whose initial investors included Credit Suisse and General Electric. Both committed approximately 9% of the US$5.64 billion of GIP I's committed capital.

The firm's first investment was announced in October 2006. It was a 50:50 joint venture between GIP and American International Group (AIG) to acquire London City Airport for an undisclosed sum. GIP announced the sale of the asset in February 2016 for a significant multiple of its acquisition price.

GIP has made two additional notable airport investments: the October 2009 acquisition of Gatwick Airport, the second largest airport in the United Kingdom by passenger traffic, for £1.5 billion from BAA, the 2012 acquisition of Edinburgh Airport for £807 million and Nuovo Trasporto Viaggiatori, which they bought in February 2018.

GIP has made a cross section of investments in other areas of the transport sector as well as the natural resource and power generation areas of the energy sector. These assets include seaports, freight rail facilities, midstream natural resources and power generation businesses.

Global Infrastructure Partners' first fund, GIP I, completed its fund raising in May 2008 with $5.64 billion in investor capital commitments. The fund became fully invested during 2012. In September 2012, GIP's second fund, GIP II, completed fund raising with US$8.25 billion in investor capital commitments, making it the largest independent infrastructure fund in the world at that time. Exceeding what it had initially projected, GIP's third fund—GIP III—completed fund raising in January 2017 with approximately $15.8 billion in investor capital commitments. GIP's fourth equity Fund, GIP IV, completed fund raising in December 2019, raising $22 billion.

GIP also manages several other Funds which focus on investments in infrastructure in other asset classes or target specific regions. GIP's Credit business manages over $4 billion across three Funds: GIP Capital Solutions I and GIP Capital Solutions II and GIP Spectrum.

In January 2024, BlackRock agreed to buy Adebayo Ogunlesi’s GIP for about $12.5 billion. BlackRock will pay $3 billion in cash and 12 million of its own shares as part of the deal to buy GIP. The 400 people directly employed by GIP will receive some of the stock and five of the six founding partners, including the chief executive, Adebayo Ogunlesi, will join BlackRock as part of the deal.

Ogunlesi is also a member of the District of Columbia Bar Association. While working at Credit Suisse First Boston, he was a lecturer at Harvard Law School and the Yale School of Management, where he taught a course on transnational investment projects in emerging countries.

In October 2012, he was appointed to the board of directors at Goldman Sachs. On 24 July 2014, he was named lead director. In December 2016, it was announced that Ogunlesi, among other business leaders, would be part of Donald Trump's Strategic and Policy Forum, which was disbanded on 16 August 2017.

Ogunlesi has been married to British-born optometrist Dr. Amelia Quist-Ogunlesi since 1985. They have two children. In his song "Wonderful," Burna Boy pays tribute to Ogunlesi, citing his hard work. Ogunlesi is the recipient of The International Center in New York's Award of Excellence. He was cited as one of the Top 100 most influential Africans by New African magazine in 2019.

#penglobalpersonality